PNC Bank is a subsidiary of the PNC Financial Services group. It provides investment and asset management services, corporate services, FDIC bank insurance products, loans and debt obligations, and more. PNC is known as one of the largest financial services companies in the United States. PNC Bank offers a wide range of banking services and financial products like loans, customer service, and mortgages.

It offers the best products and services like bank transfers, small business banking, business banking, online banking, and corporate banking. PNC is the pseudonym for the Pittsburgh National Corporation, founded in 1852. It also has various other related companies like The PNC Financial Services Group, National City Mortgage, PNC Institutional Asset Management, National City Bank, and PNC Homehq.

It also offers top PNC banking products like account, checking account, and deposit. PNC Bank Online banking is an electronic payment system that enables customers to conduct a range of financial transactions through the official website. The online business provides you with the tools that will allow you to take control of your money. The service also simplifies how you manage your finances. Most exciting part is that the service is free, easy and secure.

Customers using this service can bank at their convenience that is you can bank anytime and anywhere. PNC bank online banking enables users to deposit checks, review account activity, Check balances, pay bills, and transfer money, etc. How can I access my PNC bank online banking account on the login online banking page?

In this article, you can find solutions on how to access the PNC online backing. So as to check your account balance, view transactions, and other necessary banking activities. In the meantime, PNC is actually a worldwide banking and financial services that different range of financial services such as asset management, wealth management, loan servicing, and lots more.

The PNC online banking login is the aspect where you sign in to your online banking account to make transactions. Furthermore, the PNC online banking login or PNC online login serves as an authentication you need to pass to open your PNC bank account. In the list of the largest banking holding company in the United States, PNC appears as the 9Th by assets. Based on the aspect of the banking service it offers to members. It allows you to make deposits, access to instant card issuance, pay bills online, and lots more.

However, there are two aspects of the PNC banking services which include PNC online banking and PNC mobile banking. All PNC checking account customers get a PNC Bank Visa Debit Card and the surcharge-free use of thousands of ATMs. There is also reimbursement of some non-PNC ATM fees, free online banking and mobile banking and higher interest rates on savings as you build your balances.

With the PNC Mobile app, you can deposit checks, make cardless ATM transactions, find nearby ATMs, check your balances, set up account alerts and more. PNC Bank offers internet banking services and this has made it easy for customers to manage their bank accounts. Customers who have a bank account with the bank visit the website and login anytime provided they have valid login details.

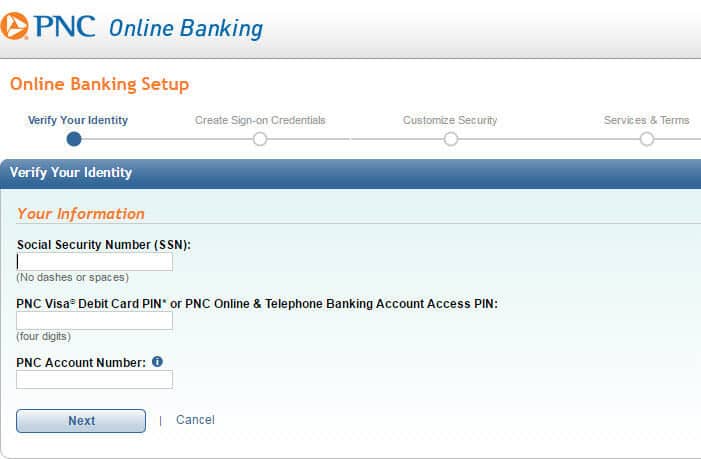

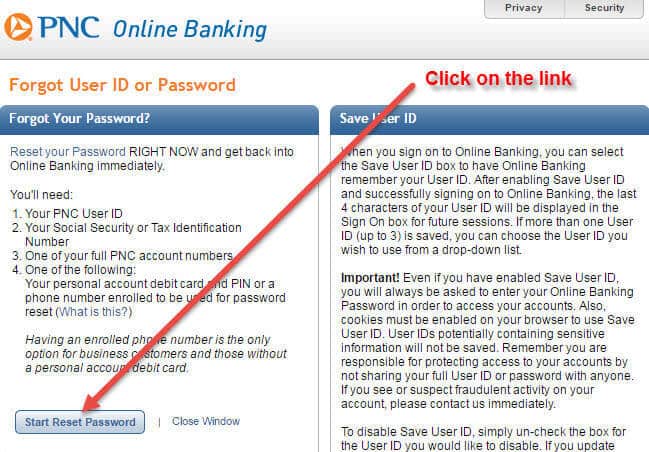

This guide will be covering all the steps involved in creating an online account with the bank, logging into the online account and resetting your password. Even PNC's premium accounts allow you to waive fees through direct deposit, a policy most banks don't follow. In addition, the saving and budgeting tools add a way to organize your finances with the Virtual Wallet account package. A few other banks also package checking and savings accounts together, but PNC's Virtual Wallet actually provides tools to help you use the accounts together in a logical way. PNC Bank, National Association, part of The PNC Financial Services Group, Inc., is the seventh largest bank by assets in the U.S. It offers a wide array of services, including consumer banking, small business banking and financial services for corporate and institutional clients.

Checking accounts-PNC Bank offers a range of checking account with overdraft options and online banking services. Their mobile banking option makes it easy for them to manage their accounts from the comfort of their homes and the bank also reimburses ATM fees for its customers. PNC offers two savings options in the Virtual Wallet bundle. Finally, you can start your banking activities where you can deposit a check, check your balance account, view your transaction history, and also your account information like your phone number.

Above all, aside from logging to the service, you can also enroll in PNC online banking to create a credential to activate your online mobile banking app. At a convenient pace, the PNC online mobile banking login allows you to easily access your bank account, and account information. Also, manage your money, pay bills, and lots more at a convenient spot. But first, you need to install the PNC mobile app on your device to log in to your mobile banking account.

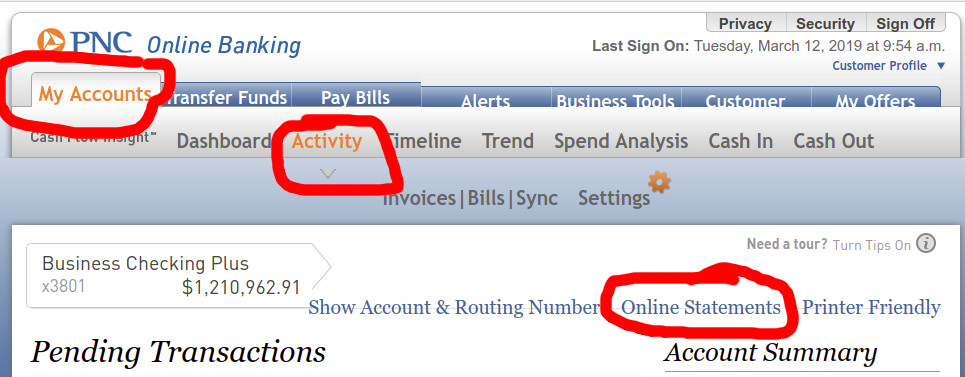

Likewise, credit cards do not have routing numbers since they are not directly linked to any bank account. If you'd like to locate your PNC routing number and account number, there are a few ways you can do that. Click on the account you'd like to work with and then locate your online statements for that account. View an online statement and the information will be displayed on it.

Next, you can also login to online banking, select an account, and from the drop-down menu next to the account click the "Show Account & Routing Number". You also can choose your SmartAccess Card from the list of accounts if you have one. Login to your SmartAccess Card account and the information will be listed under the "Direct Deposit Information" heading.

Finally, if you have checks, look in the lower left-hand corner to see your routing number followed by your checking account number. PNC Bank is the seventh-largest bank in the country by assets. Depending on their location, customers can earn up to a $300 sign-up bonus with a checking, short-term savings and long-term savings combo called Virtual Wallet. The trio of products — named Spend, Reserve and Growth, respectively — comes with a nice set of online management tools. But the interest rate on short-term savings is low, and it takes effort to avoid monthly fees on the checking account. In a statement, BBVA USA said that current Simple customers would eventually be migrated to the BBVA USA mobile app.

The bank is touting this as a good thing, since Simple customers will have access to a broader range of products and services through the BBVA USA mobile banking app. First, it's important to note that Simple accounts are already housed with BBVA USA, so you may see no immediate impact in the near term. You can still access your Simple account online or through the Simple mobile app as usual. And, if you have a debit card that's linked to a Simple checking account, it will continue to work, so you don't have to worry about losing access to your money. Is it time for you to open a bank account for your child?

The best bank accounts for kids include features that help you teach them about money management, earning interest, and more. Here are the details regarding some of the best checking and savings accounts for getting your kids on the path to great money management in adulthood. While you can get a stand-alone checking or savings account, there's no information online about how to open one. You'll want to spend some time doing your homework before opening an account. Consider combing through the details on the website or speaking to a customer rep to get your questions answered. If you find PNC's Virtual Wallet products appealing and meet the criteria to get the monthly maintenance fee dropped, it could be worth your while to open an account.

Also, if you prefer to bank with a large financial institution with a host of offerings, it might be right for you. PNC has a handful of mobile banking apps available on both iOS and Android devices. With the apps, you can check your account balances, pay bills, transfer money and deposit checks directly from your mobile device.

The apps have outstanding ratings, and the PNC Mobile Banking app is currently ranked #55 for all Finance apps on iOS, with a 4.8-star rating. PNC online banking is a platform offered by PNC bank for numerous customers who desire to have a total control of their account and fund. It is a platform that gives you access to your account details and carry out transactions such as payment of bills, transfer of money etc. A debit card gives you access to the funds in your bank account.

Policies vary by bank as to when you can open an account and get a card. You normally have open access at age 18, the age of majority in most states. Some banks allow minors access to a debit card when they open a join checking account with parents. Track your money transfer transactions via the bank's mobile banking and Virtual Wallet apps, or through the online banking app. Follow up on your international delivery by calling the branch where you made the transaction. Easy to understand your balances and set up automatic transfer to alternate savings accounts or pay bills online.

In online banking, you will first need to add an account. From within any account, select the Transfer Money icon and choose Add An Account. Once the account is added and confirmed, it can be used for transfers. You can set up same day/future dated/recurring transfers in either online banking or the mobile app.

Eligible accounts for linking to KeyBank online and mobile banking include checking, savings, credit cards, loans and investments. There isn't a maximum number of accounts you can link. Use secure online and mobile banking to deposit checks, pay bills, send money to friends and more.

The new checking account must be opened online using the application link on pnc.com/virtualwallet or at a branch through Sept. 30, 2021. The Reserve account APY is 0.01 percent on balances $1 and higher; the standard APY on the Growth account is 0.01 percent. "Relationship rates" are 0.02 percent APY on balances up to $2,499.99 and 0.03 percent APY on $2,500 and above. If you don't opt for the Virtual Wallet package and open just a single savings account, your interest rate will drop from the relationship bonus of 0.06% to the standard 0.01%. As long as you maintain the minimum waiver balance or set up automatic transfers of at least $25 from your checking, you won't be charged a maintenance fee. Most people won't join PNC just for its interest rates, but the bank's options for savings goals and automatic transfer setup can be useful if you need motivation to save.

Virtual Wallet Spend, one of PNC's basic checking accounts, has free mobile banking and online bill pay. If you use a non-PNC ATM, the bank may also reimburse some ATM usage fees, depending on where you live, though the machine's owner could still charge a separate fee. Zelle should only be used to send or receive money with people you know and trust. Before using Zelle to send money, you should confirm the recipient's email address or U.S. mobile phone number. Neither PNC nor Zelle offer a protection program for authorized payments made with Zelle. Zelle is available to almost anyone with a bank account in the U.S.

Transactions typically occur in minutes between enrolled users. To make a domestic or international wire transfer with your PNC bank account, you'll need to visit a branch location and fill out a Wire Transfer Request Form. If you are using a PNC account to send a wire transfer or receive a wire transfer in the United States, you will need to use the correct PNC routing number.

It will make sure that your transaction is completed successfully. You will have to enter the routing number for both domestic as well as international wire transfers. It can take just minutes and save you a trip to a bank branch. The top online banks are FDIC-insured and offer higher rates than typical brick-and-mortar banks, and they often charge low or no fees. Can I edit or delete a pending payment or transfer in online banking?

In online banking, upcoming activity is displayed in the account details page of each account. Scheduled payments can also be canceled from the mobile app by selecting the + button and Activity icon. Select the payment you wish to cancel in the Bill Payments menu. If you're not certain a PNC checking account is the best fit for you and you're comfortable with online banking, check out offers at other banks. Online banks and fintech startups, called challenger banks, are options if you don't need a branch location. Reviews on commercial account are also more mixed when compared to reviews of personal accounts.

Your banking experience will be influenced largely by the main bank branch and whether you like the mobile app provided by the bank or not. With DepositNow, you can deposit checks into your PNC business checking account, any time of the day or night. Use a desktop scanner or compatible mobile device to make check deposits from wherever you are.

PNC Bank is a good choice for people who want to improve their savings and budgeting habits if they live in one of the eastern states where the bank has a presence. PNC Virtual Wallet's online account management tools are more comprehensive than similar services at other banks. PNC also partners with many universities to provide on-campus banking services and financial education programs, making it a convenient choice for students attending any of those schools.

Although your debit card is associated with a bank account, you do not use a routing number for debit card transactions. Routing numbers are only used for transfers directly between bank accounts. PNC Bank is well known Bank in US PNC Bank provide Internet Banking / Online Banking services to its retail as well as corporate Bank customers. Customers can make financial transactions easily at the comfort of their home or offices once they have registered for PNC Bank Internet Banking facility. PNC Bank offers multiple ways to send and wire money, including online, mobile and ACH. You must have a checking or savings account to send money through PNC Bank.

The bank also offers an online banking service for their customer. So that it will enable a customer to bank anywhere and anytime. You can also tap HERE to visit their official site to get more details about the bank.